Worcester County’s $201.28-million FY 2019/2020 Budget Approved

The Worcester County Commissioners have approved the FY 2019/2020 Operating Budget. The budget shows a 5.9% increase over the FY 19 budget, but reduces requested expenditures of $202.6-million by $1.5-million. The additional spending includes $4.5-million in additional fudning for other post-employment benefits for county and Board of Educaiton employees, $3.0-million for the BOE operating expenses and new debt service for Showell Elementary School. There is also increased spending for waste collection and recycling operations, public safety – including new radio equipment and funding for volunteer fire and ambulance companies and parks projects.

To help fund the increase expenses, Commissioners approved an increase in the real property tax rate of 1 cent to 84.5 cents per $100 of assessed value – which will be effective on July 1st. The County’s local income tax rate will increase from 1.75% to 2.25% – effective January 1, 2020.

Anticipated General Fund Revenues

- Based on the Real Property tax rate of $0.845 NET property taxes increased by $5,005,770.

o The Homestead Credit cap remains unchanged at 3% and is estimated to be $1,264,923 for the County’s qualified principal resident homeowners effective July 1, 2019

- Local Income Tax rate will increase from 1.75% to 2.25% beginning January 1, 2020. Revenues are anticipated to increase by $3,500,000 in FY20 based on estimated receipts.

- Other Local Taxes increased by $549,000 based on current year estimates and includes an increase of $75,000 in Admission & Amusement taxes, $250,000 in Transfer Taxes and $3,000 in Food tax administration. Recordation tax increased by $162,000 with deeds being processed by the Treasurer’s Office beginning in 2020. Room Tax administration increased by $9,000 and Room Tax receipts increased by $50,000 for unincorporated areas taking into account the construction and rebuilding of new hotels and the availability of rooms.

- State Shared revenues increased $613,709 based upon estimated Highway User Fees from the State.

- Licenses and Permits increased $449,475, which includes $329,000 for homeowner convenience center permits; $29,300 for bi-annual occupational licenses, $30,000 for rental license fees, and $50,000 for building permits.

- Charges for Services increased by $275,095, including $35,000 for Roads department fees, $180,800 for recycling revenues, and $61,300 from special events fees for Recreation.

- Interest on Investments increased $425,000 based upon projected rates of return.

- Federal grants project an overall decrease of $2,184 due to declines in estimates for the US Fish and Wildlife revenue.

- State grants increased $1,301,471, which includes $461,749 from Program Open Space for Parks, $180,716 in Waterway Improvement Funds for boat landings; $824,881 State aid for Bridges, and $239,000 for a State Land and Water grant for Parks. Decreases include $559,563 for the Transportation Grant which is now included in Highway User Fees by the State.

- Transfers in:

- Planned use of Casino/Local Impact Grant and Table Games revenue increased by $831,611 overall; additional Casino grant funds of $264,900 will be used to increase the debt payment for the Worcester Technical High School in FY20, and Table Games revenue of $566,711 will be used for public safety expenditures to benefit the County.

- Transfers In of existing Budget Stabilization funds decreased by $1,698,323 since the Recycling and Homeowner Convenience Center expenses are General Fund obligations beginning in FY2020.

Major Approved General Fund Expenditures

County Departments and Agencies:

A summary of significant increases and decreases in approved expenditures include the following:

- County Administration increased $193,466

- Increased by $180,084 in salaries due to an employee retirement and replacement as well as transfer of the County Engineer from Development Review & Permitting to County Administration

- Elections Office increased $91,385

- Increased by $58,095 for salaries and benefits based on State Elections requested salary upgrades

- Increased by $26,536 for supplies and materials to cover the cost of a Presidential election in FY20.

- Environmental Programs increased $130,736

- Increased by $108,029 in salaries and includes 1 new license permit clerk and interns

- Increased by $20,130 for a Maryland Coastal Bays Grant

- Sheriff’s Department decreased by $251,646

- Decreased by $224,862 in capital equipment as compared to the current year and includes 5 replacement patrol vehicles

- Emergency Services increased by $705,053

- Increased by $96,989 in salaries and includes 3 part time Communications Clerks to assist with coverage.

- Increased by $409,760 for one-time expenses for the following: $329,211 for P-25 radio equipment which includes $141,211 for the Board of Education and $188,000 for public safety and County departments: $173,344 for the radio maintenance and software contracts; a decrease of $152,620 in radio supplies from the current year budget of which $77,265 was rededicated to Federal Engineering for consulting.

- Increased by $118,000 for one-time expenses for P-25 asset software and a radio alignment device.

- Jail increased by $243,905

- Increased by $143,354 in salaries

- Decreased by $52,789 for computers for $14,096 and inmate medical supplies for $30,000

- Increased by $145,015 mainly for the medical contract approved in January 2019 with expanded services

- Increased by $5,125 in capital equipment and includes $30,000 for two tilt skillets, $43,000 for a vehicle and decreased by $22,875 for a current year tractor purchase

- Fire Company Grant is included for $2,520,000 based on the current funding formula and $378,410 additional funds to continue the baseline minimum of $250,000 for 10 fire companies.

- Ambulance Grants is included for $4,256,592, an increase of $407,447 more than the current year based on increased rates for base personnel and the additional personnel supplement.

- A new Pilot Paramedic Scholarship Program is included for $8,000 to provide 2 scholarships each year for tuition reimbursement; an enhancement to the LOSAP award and a retention bonus is included in the FY20 budget.

- Public Works- Roads Division decreased by $750,733

- Increased by $95,664 in salaries and includes 5 part-time employees to assist with mowing along County roads

- Decreased by $566,276 as the State Transportation Grant is combined with Highway User Revenue beginning in FY20

- Increased by $156,976 for the following: $66,976 pass thru to Ocean Pines Association as they maintain their roadways through the annual agreement

- Decreased by $436,422 in capital equipment and includes $347,000 for a service truck with a crane, dump truck with snow plow, crew cab truck with dump body, trailer and mower

- Public Works – Homeowner Convenience Centers increased $752,017 as a new division in the General Fund for FY20, previously accounted for in the Solid Waste Enterprise Fund

- Public Works –Recycling increased $816,356 as a new division in the General Fund for FY20, previously accounted for in the Solid Waste Enterprise Fund

- Parks increased $590,991

- Increased by 2 part time parks workers and overtime

- Increased by $504,586 for park improvements from the State Program Open Space funds over the current year

- Increased by $9,500 to purchase a trailer and tractor with attachments for $48,500 and decreased by $39,00 for pickup trucks purchased in the current year

- Grants to Towns increased $143,575

- Increased by $32,000 for restricted fire grant to the Towns based on the current formula

- Increased by $111,575 in grants to Towns

- Insurance & Benefits increased by $2,518,833

- Decreased by $162,689 due to the County medical insurance benefits cost-share for new employees

- Increased by $1,929,000 for Other Post Employment Benefits for a total of $7,000,000

- Increased by $378,711 for Retirement contributions based upon State rates

- Increased by $134,953 for social security taxes based on the estimated payroll

- Increased by $190,022 for Workers Compensation insurance

- Increased by $70,188 in property & liability insurance due to a 3% increase in the premium

- Decreased by $26,927 for the State’s retirement administration fee

- Interfund Charges decreased by $1,303,430

- Decreased by $1,033,339 for Transfers Out to Recycling for the Enterprise Fund

- Decreased by $664,984 for Transfers Out to Homeowner Convenience Centers for the Enterprise Fund

- Increased by $394,893 to Transfer to Reserve to maintain the current 10% reserve based on the approved expense budget

- Salary accounts increased to include a 2% cost of living adjustment (COLA) for County employees, a step increment of 2.5% and longevity pay for those eligible

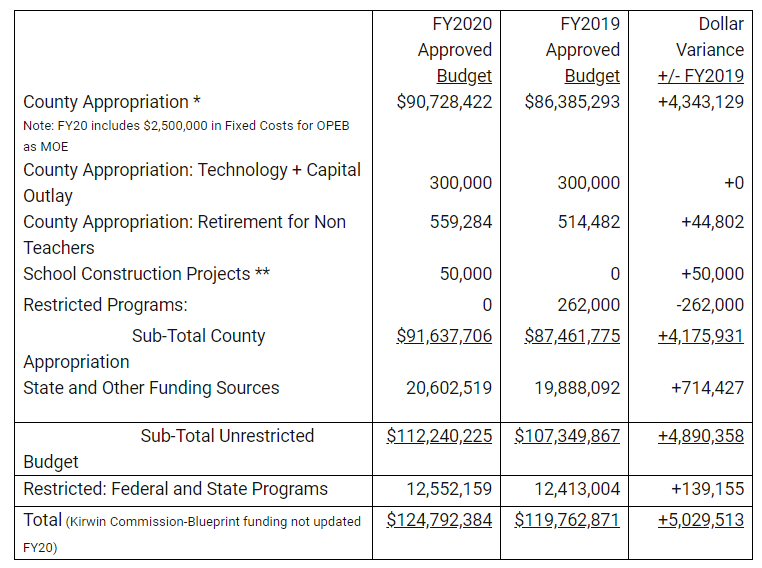

Board of Education

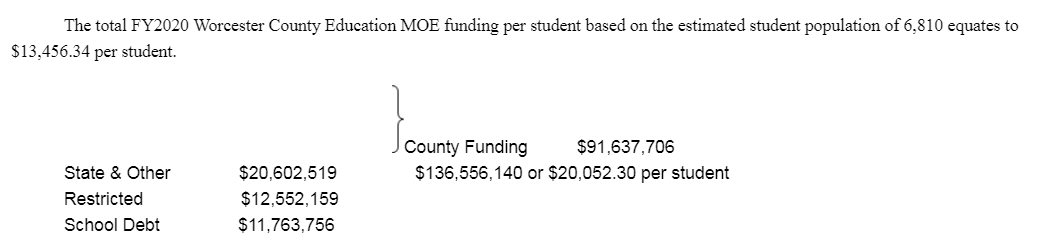

The County allocation for the Board of Education’s operating budget is $91,637,706, an increase of $4,175,931 over the current year adopted budget as shown below. School Construction debt is paid by the County on behalf of the Board of Education. It is not reflected in the Board’s budget; however, it is included in the County’s operating budget. The Board’s approved Operating budget of $91,637,706 plus debt service of $11,763,756 totals $103,401,462 or 51.3% of the County’s total estimated revenue.

Image courtesy Worcester County Government

*Fiscal 2019 Maintenance of Effort (MOE) level of $86,685,293 is affected by the escalator provision:

- An MOE escalator provision will take effect in FY20 for 1.00463509%. This provision was enacted as part of Senate Bill 848 of 2012, Section 5-202(d)(ii)2 and became effective FY15. Due to a negative statewide average for FY15 and FY16, the escalator effects FY17-FY20.

- MOE requires an increase of $1,843,129 in FY20.

**FY2019&FY2020 Construction projects funded through fund balance excluding $50,000 for portable classroom repairs for Stephen Decatur Middle School in FY20.

Board of Education Salary Increase:

The Board of Education budget includes the following salary adjustments for FY20:

- The salary package for the Board of Education reflects a payroll increase of $2,353,403, which includes a step, longevity step for those eligible and salary scale adjustments as negotiated with a 2% COLA for Teachers and Support Staff employees.

- The bus contracts account increase over FY19 is $83,264 and reflects a 2% increase to bus contractor’s hourly, mileage and per vehicle allotment (PVA) rates effective July 1, 2019. The increase includes funding to several contractors to purchase new buses for $14,000 and $45,000 to cover increasing costs for athletic transportation.

- Starting Teacher pay increase by 2.0% from $44,700 to $45,594, and will be adjusted for the additional State Aid for Kirwan Commission-Blueprint funding for beginning teachers pay.

Image courtesy Worcester County government