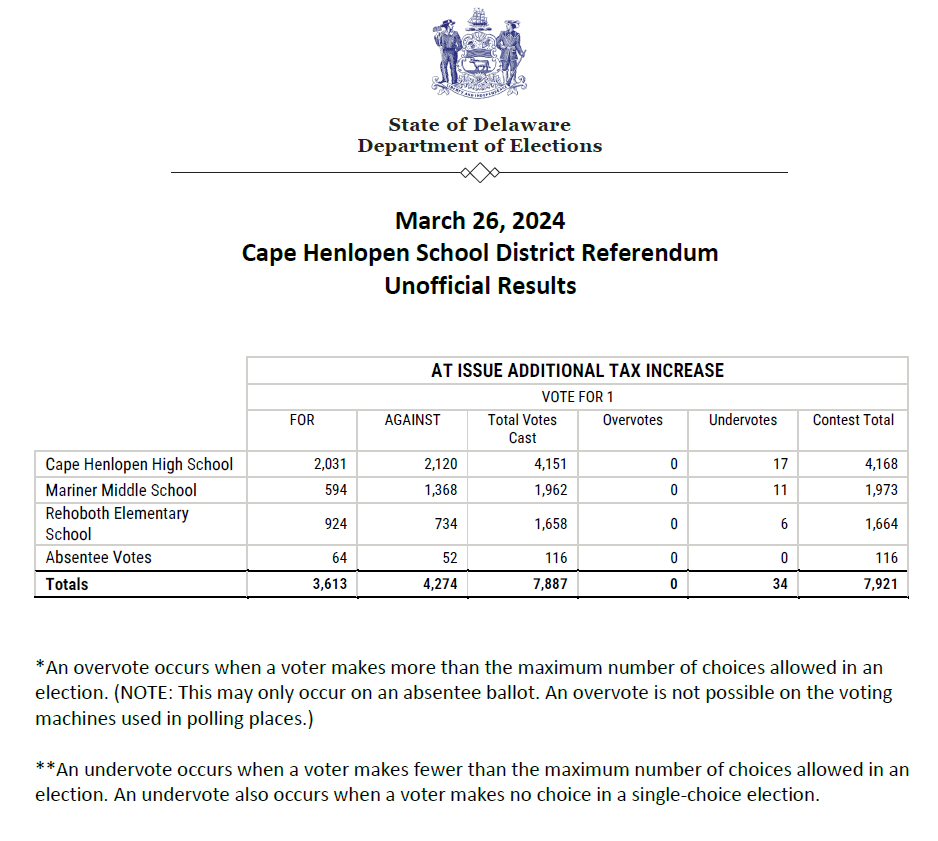

UPDATED: Cape School District Voters have Denied a Referendum Vote to Raise Taxes

03/26/24 – 10pm – Cape Henlopen School District voters have denied a referendum vote to increase the tax rate to cover costs for current operating expenses and issue bonds for major capital projects. There were 3,613 votes for the referendum and 4,274 votes against.

The referendum will be certified on Thursday.

=========================================

03/26/24 – 11:25am – Voters in the Cape Henlopen School District have been voting since 7am in today’s referendum vote to increase the tax rate to cover costs for current operating expenses and issue bonds for major capital projects – including the purchase of over 102 acres of land, relocate the district office, build a natatorium (pool) and construct a bus maintenance facility. Voters have until 8pm to cast their vote – or turn in their absentee ballot. Ballots can be cast at Cape Henlopen High School, Mariner Middle School or Rehoboth Beach Elementary School.

=========================================

Tuesday is the Cape Henlopen School District referendum. The referendum is to propose a new tax rate to generate local revenue. According to the District website, the revenue generated from the approved tax increase will help the District address expenditures due to the increasing enrollment. Enrollment issues continue to be the main reason more funds are needed. Cape Henlopen School District enrollment has grown from 4,150 students in 2001 to 6,587 students as of September 2023 and population studies show that the enrollment will continue to increase significantly over the next 10 years.

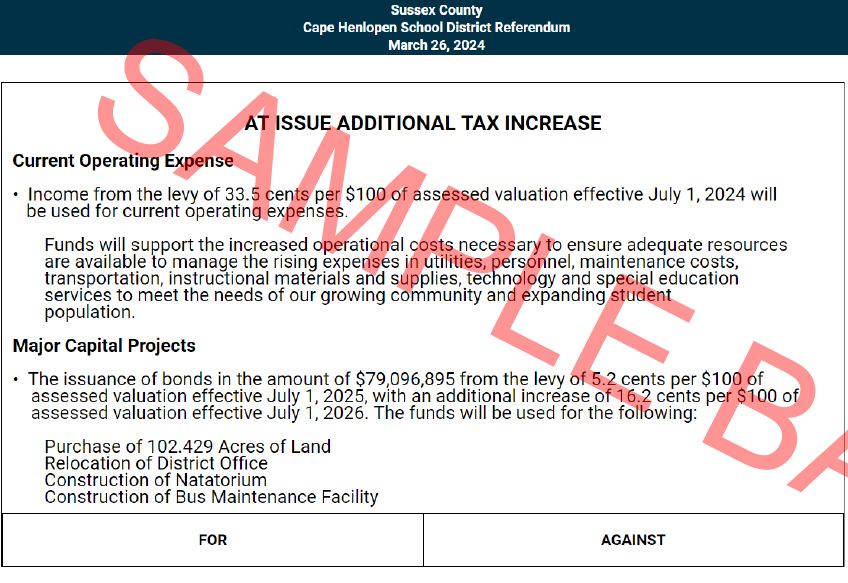

This Referendum proposes a current expense tax increase and a phased increase in the debt service tax rate over a period of three years. Specifically, we are suggesting a $0.335 tax increase for current expenses and a gradual $0.214 tax increase for debt services. This will amount to a cumulative rate increase of $0.549 per $100 of assessed value of the home, fully implemented over the three-year period. The incremental increase would enable the District to support the increased operational costs necessary to ensure adequate resources are available to manage the rising expenses in utilities, personnel, maintenance costs, transportation, instructional materials and supplies, technology, and special education services to meet the needs of our growing community and expanding student population. In addition, the increase in debt service tax will allow us to proceed with the purchase of land for future expansion. This expansion includes the relocation and construction of a district office to make room for Cape Henlopen High School, a natatorium (pool), bus maintenance facility, and district operations.

According to the sample ballot on the Cape School District website, there is now just one question for voters to respond to in regards to the referendum. The polls are open from 7am to 8pm at Cape Henlopen High School, Mariner Middle School and Rehoboth Elementary School.