Delaware Dept. of Labor mistake causes tax headache for businesses

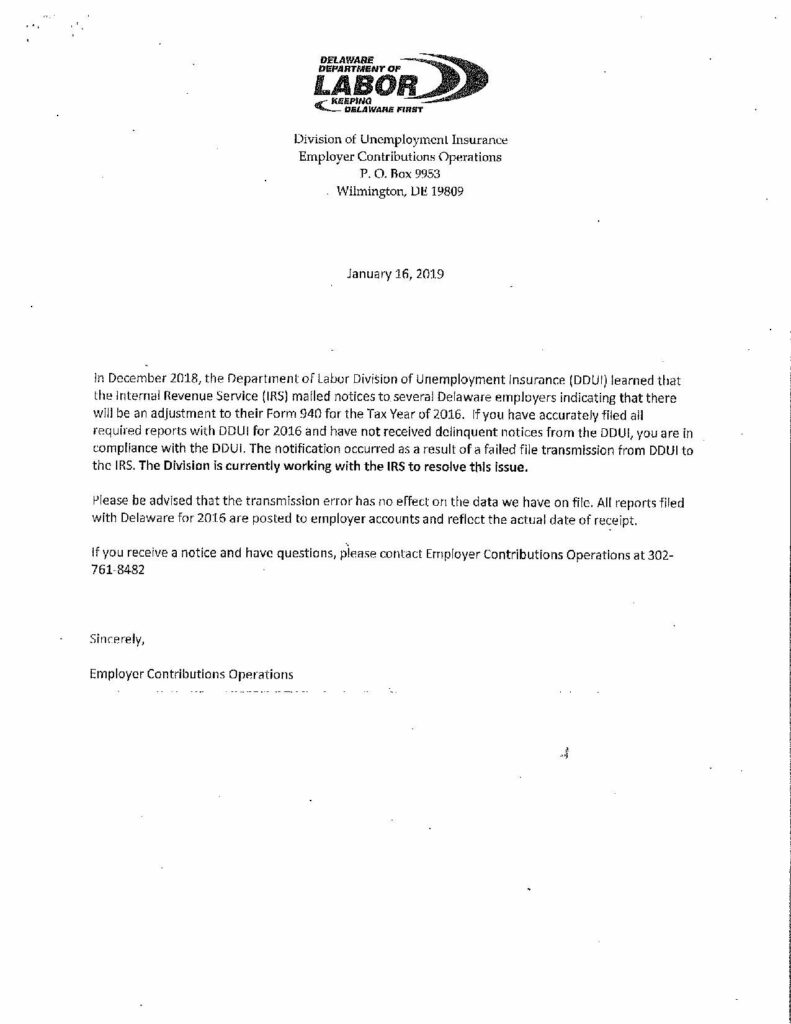

A “transmission error” by the Delaware Department of Labor has created a tax headache for businesses statewide after the agency failed to report necessary information to the IRS.

In 2016, the Delaware Department of Labor had an issue reporting to the IRS the total amount of taxes paid on the 941 Tax Forms. As a result, several businesses have recently been getting notices from the IRS stating that they owe money for 2016.

Among the businesses affected was WGMD, it took our Business Manager Sandy Christensen several months to resolve the issue created by the state’s Department of Labor.

“It started in January and the whole thing took about eight and a half months to fix,” Christensen explained. “It took a while to resolve.”

If you or your business receives such a form from the IRS, you will need to contact the Delaware Department of Labor and request a certified 941 Tax Form for 2016 showing what was actually paid. In addition, you will then have to return this form to the IRS along with your notice so that they can get the correct data for that reporting period.

WGMD News has reached out to the Delaware Department of Labor with a host of questions regarding the error, including why businesses are responsible for correcting the issue they caused.